The costs of hiring employees in your business

4 Jan. 2023

When a company needs to hire more team members, it’s a great indication that business is booming. However, moving from the role of sole business owner to an employer is challenging - especially when you’re responsible for paying that person’s income.You will need to decide how much you’re going to pay your employees, whether they’re on a salary or hourly contract, and if so, how many hours they’re going to work.

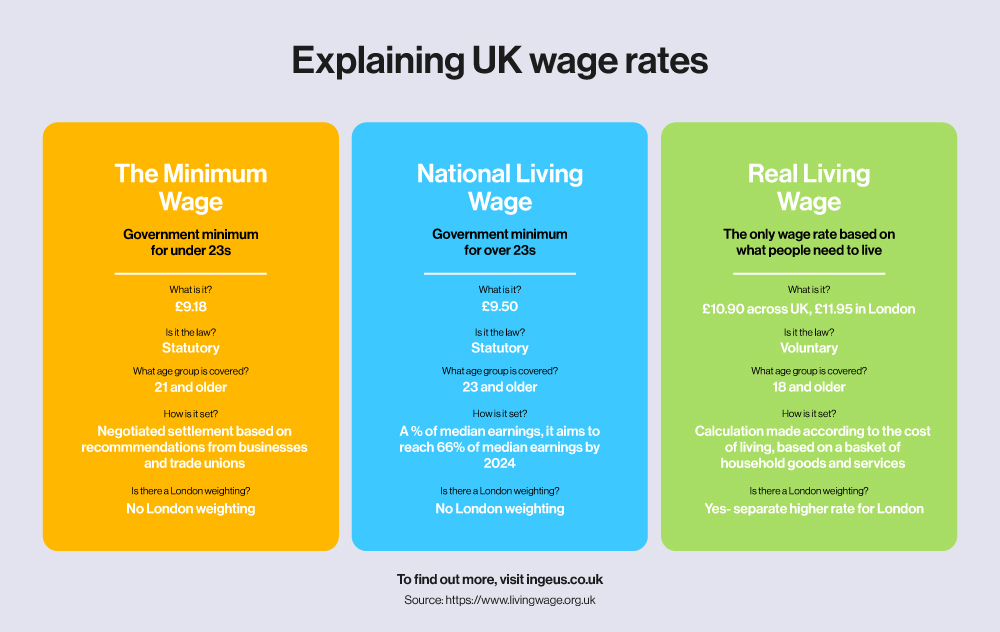

National, Living and Real Living Wage

When it comes to pay, there are three types of wage; National, Living and Real Living. National wage is the legal minimum wage that employers legally must pay their employees. Living wage is the wage someone would need to sustain a good standard of living in accordance with location and family size. The Real Living Wage is independently calculated by the Living Wage Foundation.

According to GOV.UK, minimum wage is £9.18 per hour, and National Living Wage is £9.50 per hour. Rates depending on age are as follows:

| Age | Minimum Wage, Per Hour |

| 16-17 | £4.81 |

| 18-20 | £6.83 |

| 21-22 | £9.18 |

| Apprentice (under 19) | £4.81 |

The Real Living Wage is set by the Living Wage Foundation and sits at £10.90 for the UK and £11.95 for London.

In an ideal world, if you can afford to pay your team the real living wage, you should.

The Essential Costs Of Employment

Employers often make the mistake of thinking the only cost that comes with recruiting new employees is their salary, but there are many other costs associated.

- You must pay Employer’s NICs (National Insurance Contributions) on any salary above the National Insurance Secondary Threshold, but this can be offset through the government’s Employment Allowance scheme.

- For employees over the age over 22, employers must auto-enrol them into a pension, and make a minimum of a 3% contribution.

- You must have Employers’ Liability Insurance.

- Any software, uniform or equipment needed for employees to successfully do their jobs.

- The costs of running any compliant payroll or HR software.

Employee entitlement costs

On top of tax, national insurance and pension contributions, you must also pay the following whilst they’re not working in accordance with the UK government:- Statutory sick pay (SSP) - eligible employees are entitled to £99.35 a week for up to 28 weeks.

- Statutory annual leave - full time employees are entitled to 5.6 weeks of holiday pay a year.

- Statutory maternity leave of up to 52 weeks.

- Statutory paternity leave of up to 2 weeks.

Hidden Employee Costs

It isn’t just contributions, salaries and entitlement pay that you must consider. If you want to retain your employees and see your business thrive, you’ll need to provide training and support.According to Growth Business, “the true cost of hiring staff is almost double their salary during the first year of employment.” From covering salaries to office space and equipment, research revealed that new hires cost twice their annual salary in the first year.

The Cost of Recruitment

Finding the right team members also takes time and money - if you rush the hiring process, you risk hiring the wrong person, which can be a costly mistake.According to the British Business Bank, it costs a business an average of £3,000 to hire someone on an average UK salary if they use a recruiter. If you choose to bring a recruitment agency in, you’ll have access to a much wider pool of talent, but you’ll end up paying a 10-30% fee on top.

Offset The Cost Of Employment With Ingeus

If you’re looking to reach more talent in the UK and expand your team, Ingeus is here to help. We offer bespoke, government funded, recruitment and retention services that are tailored to the needs of your business and aim to help people get back into work.Get in touch and find out more about our free services for employers.

.png?width=1709&height=843&ext=.png)

.png?width=1165&height=190&ext=.png)